2020 tax bracket calculator

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Ad Access Tax Forms.

Inkwiry Federal Income Tax Brackets

Below is an example salary.

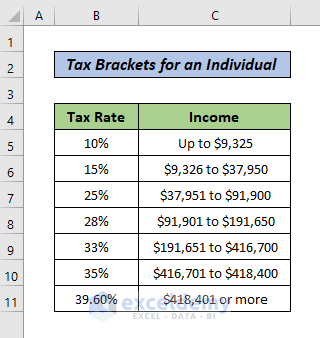

. A tax bracket is a category used to define your highest possible tax rate based on your filing status and taxable income. 10 12 22 24 32 35 and 37. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. There are seven tax brackets for most ordinary income for the 2020 tax year. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Up to 38700 and youll be taxed. Ad Complete Past Years Taxes And Get Your Maximum Refund Guaranteed.

The new 2018 tax brackets are. Calculate your income tax bracket 2021 2022. Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax.

TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. It is mainly intended for residents of the US.

Your Federal taxes are estimated at 0. Income Tax Tables are used to calculated individual salaries apply tax deductions and tax credits to produce a net take home pay your income after deductions. Estimate your tax refund with HR Blocks free income tax calculator.

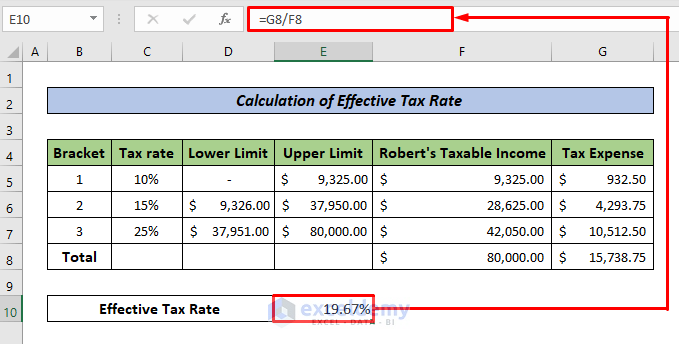

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. Find out your tax refund or taxes owed plus federal and provincial tax rates. 10 12 22 24 32 35 and 37.

As of 2016 there are a total of seven tax brackets. This is 0 of your total income of 0. Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution Ani Globe.

There are seven federal tax brackets for the 2021 tax year. 9525 or under means youll be taxed at 12. Find Everything You Need To Quickly Finish Your Past Years Taxes.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The AI-powered tax engine finds every possible tax deduction to. Your tax bracket depends on your taxable income and your.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. And is based on the tax brackets of 2021 and. Effective tax rate 172.

The tax bracket calculator is one of many FlyFin features geared specifically toward freelancers and the self-employed. Your bracket depends on your taxable income and filing status. In other words your income determines the bracket you will be.

Complete Edit or Print Tax Forms Instantly. Your tax bracket is. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

If you are a single taxpayer the IRS tax brackets for the upcoming tax filing season are as follows. 0 would also be your average tax rate. It can be used for the 201314 to 202122 income years.

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Inkwiry Federal Income Tax Brackets

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Tax Withholding For Pensions And Social Security Sensible Money

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

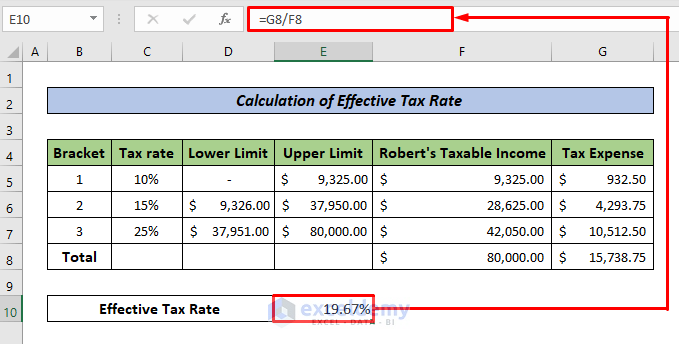

How To Calculate Federal Tax Rate In Excel With Easy Steps

How To Calculate Federal Income Tax

How To Calculate Federal Tax Rate In Excel With Easy Steps

2020 Tax Return Calculator Discount 51 Off Www Ingeniovirtual Com

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Inkwiry Federal Income Tax Brackets

Income Tax Formula Excel University

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download